Remember there are grades of recession!

04 August 2022The word recession can strike fear into many people's hearts. To be fair, it's not an unreasonable reaction, and not a great economic situation for a country or trading area. Controlled growth usually works well in a capitalist society, and unbridled growth ironically leads to recession at some point. 'No more boom and bust', as one senior UK politician once said, is something of an impossibility.

There are grades of recession, some being deeper than others. A bit like a winter cold, sometimes it's just a sniffle for a day or two, and sometimes it's a week in bed feeling dreadful. If we likened this to the economic effects of a recession, if a recession in the UK was like the former example above, you and your personal finances may not know much about it. If, however it's a deep economic recession, then your money planning might be laid up a while.

The definition of recession is two consecutive quarters of negative gross domestic product (GDP). Indeed, it is always the case that you will only know that an economy is officially in recession when the results are announced a time after the end of a three-month period. So, you could be in a recession period and not officially know it.

The battle to keep raging inflation rates under control of late is on in most developed western economies, and the tool of choice selected by most central banks is the use of base interest rates to slow growth by raising the cost of capital. The Bank of England has raised base rates in 2022 to 1.25% so far this year, with further rises expected. Later today, the next rate decision is due, with much speculation that rates will rise a further 0.5% to 1.75% (not guaranteed).

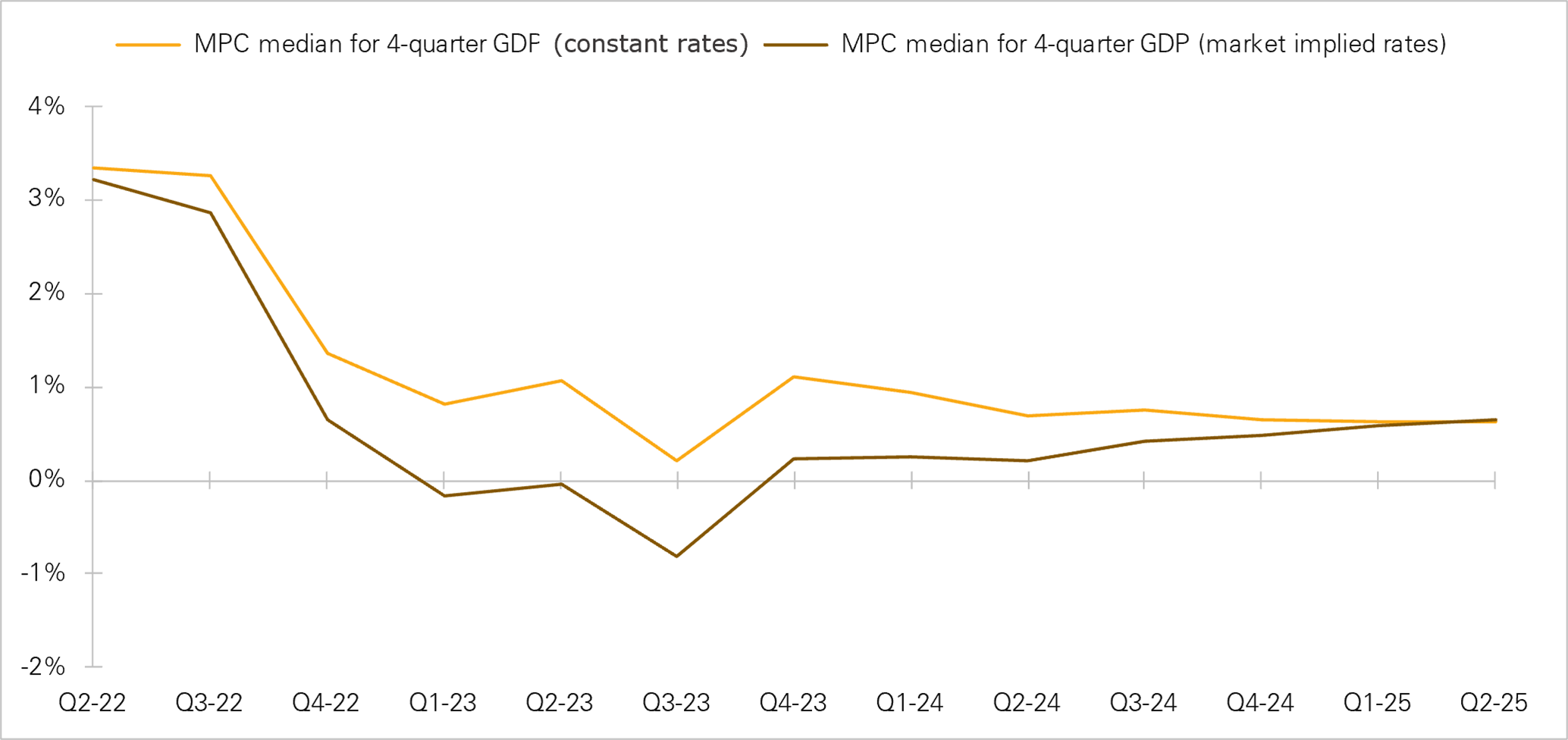

Current inflation (and future expectations / not guaranteed) are illustrated below:

(Source / Cormorant Capital Strategies)

One key take-away from this graph is that you can see that higher inflation rates are expected to continue for another 18 months or so if the projections prove correct. So, from a budget planning perspective, don't think that inflationary pressures on your household budget will disappear any time soon. It might be a difficult Christmas 2022, with energy, petrol and food costs remaining high, and perhaps increasing further. And if you have variable rate debt, remember that base interest rate rises are likely to push up your borrowing costs further.

As noted, the purpose of raising base rates is to control inflation, and this will have an effect on GDP. Cormorant Capital Strategies notes:

The yellow line represents the Bank of England's forecast for UK GDP over the next few years conditional on there being no increases in interest rates. In early May, when these figures were released, Bank Rate stood at 1.0%. The darker line represents the Bank's forecast for GDP assuming that interest rates rise to somewhere in the region of 2.5%. The yellow line shows positive progress throughout, the darker line does not. The darker line is consistent with a recession during the first half of next year. Actually, the market inferred rate of interest has risen further since these forecasts were made, up from 2.5% to 3.5%, meaning that the recession indicated in that chart may come sooner or it may strike deeper, or it may last longer (or some combination thereof).

These assumptions are not guaranteed but give an indication of what might happen. You can see that if these positions were correct, the cold we might all catch should be mild.

Investments

At the time of writing (June 2022), many will be aware that there has been significant market volatility over the last few months, directly and indirectly related to the points above and of course to the conflict in Ukraine. Most markets have factored these points in (again not guaranteed) and we hope to see a more positive position looking forward (not guaranteed), although concerns about inflation persist.

As you may be aware, past performance is not a guarantee of future performance.

Summary

I appreciate that the blog notes above prove perhaps to be a bit of an economics lesson. However, they do offer an insight into what might lie ahead. The overall message is that it's going to be a year or two for the UK economy to bring its inflationary pressures under control, and households should plan for this.

There are usually actions that individuals can take to reduce costs and increase income. Making your money work as hard as you do is never more important than now. Seek advice from Chapters Financial, or your financial planner, to make sure that efficiencies in your money planning are maintained as we move through the summer, and into, perhaps, a winter of discontent (see 1979!).

As always with our topical blogs, no individual advice is provided during the course of this blog.

Keith Churchouse FPFS

Director

CFP Chartered FCSI

Chartered Financial Planner

Chapters Financial Limited is authorised and regulated by the Financial Conduct Authority, number 402899